Wills Lawyer Des Moines IA

A wills lawyer in Des Moines, Iowa, can help answer any questions you may have about your last will and testament – chances are, you’ve got a lot.

If you’ve already written up a will, great job: You’ve taken steps to ensure that your heirs, other family members, friends, and anyone else included in your will is taken care of after you die. A will is definite peace of mind, and to many of us who spent a bit of time planning for the inevitable, we might think that our will is the end of the line. “Probate? Never heard of it.” But, what if you’re named in someone else’s will? Suddenly, learning about the probate process just got a lot more interesting.

An estate is someone’s last legacy, and if you’ve written up a will, you’ve made a wise choice by ensuring your legacy will live on through your loved ones. But if you’ve been named in a will, and that generous someone in your life has just passed away, it’s just the beginning of a long, complicated (and expensive) process – and you’re along for the ride.

- What Not to Do When Writing a Will

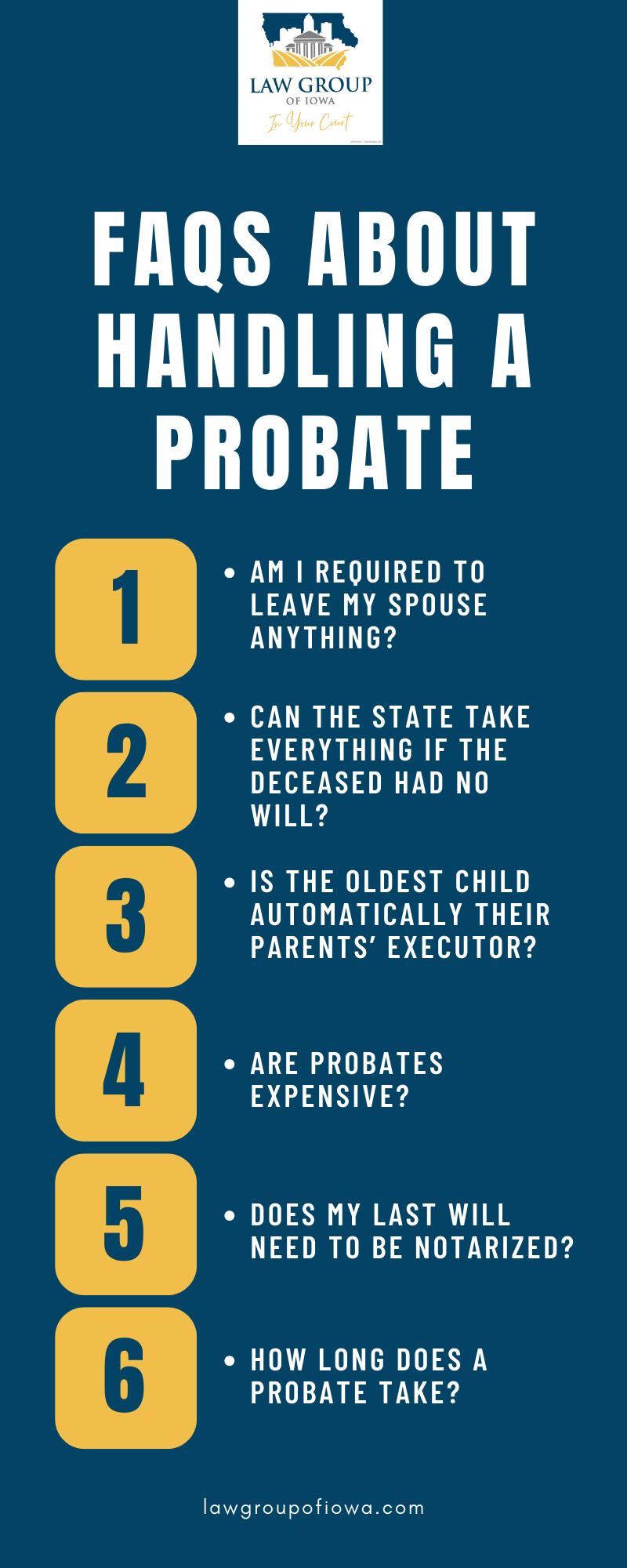

- Des Moines Wills Law FAQs

- Des Moines Wills Infographic

- When You Should Update Your Will

- Inside the Probate Process

- Law Group of Iowa Des Moines Wills Lawyer

- Des Moines Wills Law Statistics

- Des Moines Wills Lawyer Google Review

What Not To Do When Writing A Will

Attempt to Write a Will Without Legal Counsel

You should never attempt to produce your will without consulting the professionals at the Law Group of Iowa. If you’re not thoroughly versed in the rules and requirements for writing a will, you may not be able to create one that is legally binding. When you’re ready to work on your will, get in touch with your wills lawyer in Des Moines, IA, first.

Only Write a Joint Will With Your Spouse

While it isn’t ideal to expect the worst, you never know when situations between you and your spouse might change. If one of you passes away before the other or you possess assets that aren’t jointly owned, issues may come up in the settling of the joint will later on. Furthermore, many states don’t actually recognize joint wills; it’s ideal to develop your own individual will with the Law Group of Iowa, and you can always include your spouse as a beneficiary.

Exclude Your Pets

Your pets are technically considered property by the state, which means they count as an asset that will need settling in the event that you pass away. Consult with your wills lawyer in Des Moines, IA, to discover the best way to include your pets in your will. Doing so gives you the chance to designate a caretaker for them, preventing them from being transferred into state custody when you’re gone. If the pet is solely yours, it should be included in your individual will, not a joint will.

Forget to Update Your Will Regularly

You may think that once you’ve written a will, you’re good to go and no further action is required. In fact, it’s important to regularly update your will, and you should have legal counsel when doing so. Nearly any wills lawyer in Des Moines, IA, will recommend that you update your will if your assets change significantly, or in the event of a birth, death or divorce. If you’re unsure when to update your will, you can always reach out to your legal team for more clarity.

Alter Your Will Outside Official Legal Situations

It’s critical that you only alter your will with help from your lawyer, so don’t attempt to change the documents in any way without legal counsel. Whether you try to make content changes or otherwise decorate or ‘dress up your will, you could potentially undo any legal binding it held.

Des Moines Wills Law FAQs

Am I Required to Leave My Spouse Anything?

You technically have no legal obligation to leave your spouse anything in your will – couples often choose to do this for a wide variety of reasons. This is perfectly fine as long as both parties continuously agree on the terms of the will. However, if the surviving spouse changes their mind after their partner passes away, they or may choose to contest the agreement and instead pursue the elective share of the estate.

Can the State Take Everything If the Deceased Had No Will?

If the deceased had no will, assets are divided between the next of kin. The Law Group of Iowa will usually start with a living spouse; if there isn’t one, they’ll move on to living children. The state can only take assets from the estate if no living relatives can be found.

Is the Oldest Child Automatically Their Parents’ Executor?

If a deceased parent designated one of their children to be the executor after they pass, the oldest sibling doesn’t have any say. However, if the parent did not name an executor, the state will approach a living spouse before anyone else took the job. If there is no surviving spouse, the state will then approach the children. This usually leads to one of two outcomes: either the children designate an executor amongst themselves, or they all opt to be co-executors in the will.

Are Probates Expensive?

Nearly any wills lawyer in Des Moines, IA, will tell you that most probate cases don’t even require a proceeding. Those that do only account for around 5% of the estate’s value.

Does My Last Will Need to Be Notarized?

Whether a will needs to be notarized is up to each state, but it isn’t necessary in some cases. In places like California, a last will only need to be signed by the testator as well as two witnesses. Ask your wills lawyer in Des Moines, IA, for more information.

How Long Does a Probate Take?

The length of time it takes to settle probate can vary, but almost any wills lawyer in Des Moines, IA, can complete the process in a few months. It may take upwards of a year in some cases; for example, if the deceased has ongoing income after they pass away or a particularly large estate, dividing the assets may be more complex. If the family frequently argues, it may take longer for the Law Group of Iowa to finish the probate.

Des Moines Wills Law Infographic

When You Should Update Your Will

Too many people establish a will and never look at it again. This is a mistake. Your life circumstances are likely to change over time. When this happens, it is necessary to take another look at your will. Otherwise, your will might not reflect your current wishes. Below are a few signs that you need to update your will as soon as possible:

Your financial situation has changed. If you receive a large inheritance or accumulate assets that significantly improve your financial situation, you will want your will to reflect that. After all, you want your beneficiaries to have access to all of your assets after you are gone.

You are planning to get divorced. If you are thinking about getting a divorce, you should update your will before you officially file. If you die suddenly without completing your divorce, your spouse will have rights to your assets.

A beneficiary has substance abuse problems. It can be shocking to discover that one of your beneficiaries has developed a substance abuse problem. One of the next steps you should take is to make the appropriate changes to your will. Your beneficiary might not be able to think clearly and make the wrong decisions with his or her inheritance. You may want to add a trust that allows a third party to distribute money to your beneficiary under certain circumstances.

You moved to a different state. Not all states have the exact same estate planning laws. As such, if you move to a different state, you should update your will immediately. Otherwise, your will might no longer work the way you intended it to.

Your relationships have changed. It is not uncommon for people’s relationships to change over time. If you no longer get along with the people named in your wills, such as your beneficiaries, executor, or guardian for your children, it is time to contact your wills lawyer in Des Moines, IA, and make the necessary changes to your will.

You were diagnosed with a medical condition. If you recently found out that you have a serious medical condition, it is definitely time to have another look at your will. Your lawyer may advise you to appoint a healthcare proxy in case you lose the ability to make good decisions in the future.

Des Moines Wills Law Statistics

According to a caring.com 2022 wills survey, 56% of Americans believe that estate planning is important but 66% of adults don’t have a will in place. Here are some recent estate planning statistics:

- 32% of Americans have a will

- 46% of will executors were aware of a will

- 32% of adults under 35 said they wrote a will because of COVID-19

Wills Lawyer Des Moines, IA

If you need a wills lawyer in Des Moines, IA, the Law Group of Iowa is the place to start. If you’re like many you know you should have a will so that your estate passes to the people, pets, and institutions of your choice, but you really don’t know much about wills.

Simply put, your will, which is also known as your ‘last will and testament,’ is a legal document you create or cause to be created declaring your choices about the distribution of your estate when you pass. If you don’t have one now, creating one will give you a certain piece of mind knowing that you’ve covered the basics.

Inside the Probate Process

Probate is – at its simplest – the process of authenticating and executing a will. It goes through a special court (probate court) and it’s how your assets are collected, divided, and distributed between your beneficiaries. However, it’s much more complex than it sounds. First, there’s the matter of authentication: a will needs to be authenticated to ensure it’s not a forgery. Simple. Next, the executor needs to be named. The executor is the person who will be in charge of your affairs after you’ve died, and if they’re named in the will already, even better. Again, simple.

Once a will is authenticated and an executor is named, your assets need to be located. (A bond can be posted as an insurance policy in case the executor makes any costly mistakes, but it’s actually optional.) The value of the assets will need to be determined. Creditors need to be notified, and debts need to be paid off. Taxes need to be filed, and only then can the estate be divided. Simple. Simple. Simple.

Except it’s really not as simple as it sounds. If you look back at the steps of the probate process, it might seem straightforward. But you also need to remember that probate means everyone who wants to contest the contents of a will, can. The will’s authenticity? Someone can argue that it looks fake. The executor? Someone can contest who gets to be in charge of the estate. The value of assets, the debts to be paid – everything is up for debate, and before you know it, months (or even years) have passed.

If you don’t want this to be a huge problem for your family and friends after you die, it’s a good idea to get in touch with a wills lawyer in Des Moines, IA.

How to get started

Law Group of Iowa is pleased to offer you a no-cost no-obligation consultation about setting up your will. You might want to prepare for such a meeting with a list of your assets. It’s also a good idea to bring a list of your questions to this first session too.

The top of every web page has our phone numbers. Feel free to call us. You’ll also find our contact page has an email form you’re welcome to fill out and use if necessary. It also has our physical address. And if necessary we can even come to you. Don’t hesitate to tell us what you need and we’ll do our best.

Reach Out To Law Group Of Iowa Today

At Law Group of Iowa, we understand that the probate process can be challenging, frustrating, and bitter, and we know that having a concrete will is the best way to avoid as much trouble as possible for your beneficiaries. Many people might think that their will is final, but unless it’s been properly prepared, there’s always the potential for infighting – at a time when people should be grieving and caring for each other, no less.

Don’t leave anything up to chance. Reach out to a qualified wills lawyer in Des Moines, IA, and see how the Law Group of Iowa can help you.

Exploring Estate Law In Iowa

A Des Moines, IA wills lawyer can explain how estate law is vital in ensuring the smooth transfer of assets and property upon an individual’s passing. Understanding the specific laws related to estate planning and administration in Iowa is crucial for individuals and families seeking to protect their assets and provide for their loved ones. The following is a brief overview of Iowa law. For more detailed information, call the Law Group of Iowa.

Iowa Probate Code

The foundation of estate law in Iowa is the Iowa Probate Code, codified in the Iowa Code Chapter 633. This code outlines the procedures and regulations governing the distribution of a deceased person’s assets and the administration of their estate.

Wills And Intestate Succession

In Iowa, a valid will allows individuals to specify how their assets should be distributed upon death. If a person dies without a will (intestate), the state’s laws, specifically Iowa Code Chapter 633.211, dictate how their property is distributed. Understanding the implications of intestate succession is important, as it may not align with your wishes.

Probate Process

Probate is the legal procedure through which a deceased person’s assets are distributed and their estate is settled. In Iowa, probate proceedings generally occur in the county’s district court where the deceased person resided. The process can be complex, involving identifying and valuing assets, paying debts and taxes, and distributing remaining property to heirs or beneficiaries.

Iowa Inheritance Tax

Iowa is one of the few states that impose an inheritance tax. This tax is levied on property received by beneficiaries or heirs after a person’s death. The amount of tax depends on the relationship between the deceased person and the beneficiary and the value of the inherited property. Proper estate planning can help minimize the impact of inheritance taxes.

Power Of Attorney

A power of attorney is a legal document granting another person the authority to make financial and legal decisions if you become incapacitated. In Iowa, the Power of Attorney Act (Iowa Code Chapter 633B) governs the use and execution of power of attorney documents. These documents are crucial for ensuring that your affairs are managed in the event of your incapacity.

Advance Healthcare Directives

Advance healthcare directives, such as living wills and healthcare power of attorney documents, allow you to specify your medical treatment preferences and appoint a trusted individual to make healthcare decisions on your behalf if you cannot do so. These documents are regulated under Iowa law (Iowa Code Chapter 144B) and provide guidance to healthcare providers and family members in critical situations.

Trusts In Iowa

Trusts are a valuable estate planning tool in Iowa, enabling individuals to manage their assets, avoid probate, and provide for specific beneficiaries. The Iowa Trust Code, found in Iowa Code Chapter 633A, governs the state’s creation, administration, and termination of trusts. A Des Moines wills lawyer can explain the different types of trusts available.

Estate Tax In Iowa

Iowa imposes an estate tax on estates with a net value exceeding a certain threshold. This tax is separate from the federal estate tax and can significantly impact the distribution of assets to heirs. Understanding the estate tax laws in Iowa is essential for effective estate planning.

Seeking Legal Guidance

Estate planning and administration involve intricate legal processes, and the laws can be complex. To ensure that your assets are protected and your wishes are carried out effectively, it is advisable to seek legal guidance from experienced estate planning attorneys.

Contact the Law Group of Iowa today to discuss your estate planning or administration needs with a dedicated Des Moines wills lawyer. Our compassionate and experienced attorneys are here to provide you with the legal support and guidance necessary to protect your assets and ensure your wishes are honored. Your peace of mind and the security of your loved ones are our top priorities, and we are dedicated to helping you achieve your estate planning goals.

Law Group of Iowa Des Moines Wills Lawyer

5601 Hickman Rd. Suite 3B Des Moines, IA. 50310

Des Moines Wills Lawyer Google Review

“I was impressed with the professionalism demonstrated by Tom…his direction and guidance were deeply appreciated…concluding with a generous verdict in our favor…double dancing thumbs up!!” – Thomas S.